Accounting Software

About Accounting Management System

Accounting management software is designed to simplify finance for businesses in various sizes. The management of an invoice, expenses, payroll, and tax compliance is maintained accurately and avoids manual errors due to its feature. Real-time tracking of finances, automated reporting, and secure storage of data, accounting management software will equip the business in making informed decisions and maintaining transparency. Its user-friendly interface and customizable options cater to diverse industries, streamlining operations and saving time.

Technologies Used

Secure and efficient technologies powered our efforts to rapidly deliver new functionalities and features.

HTML5

CSS

JavaScript

PHP

Laravel

Python

Node.js

PHP

Laravel

MySQL

Firebase

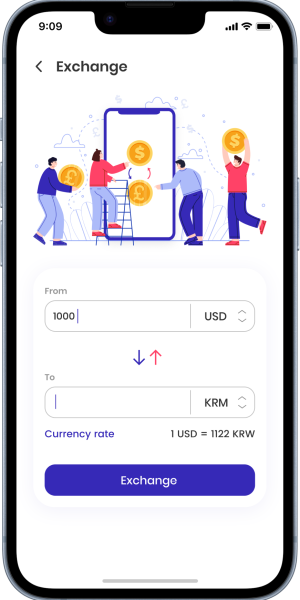

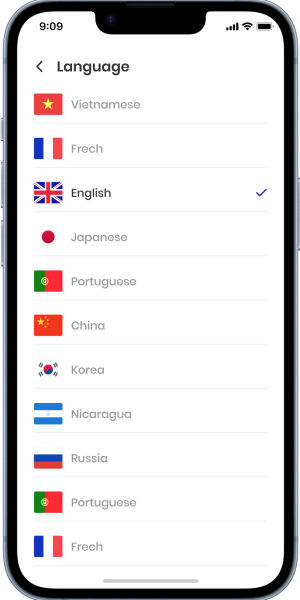

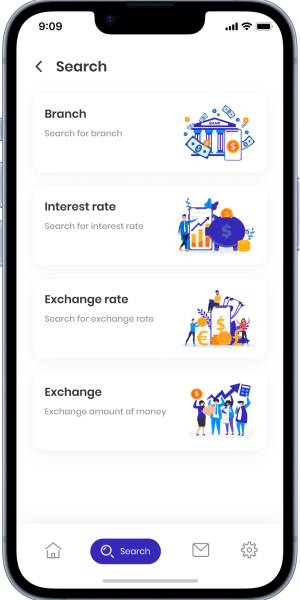

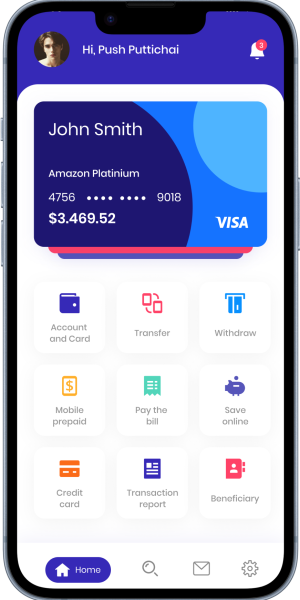

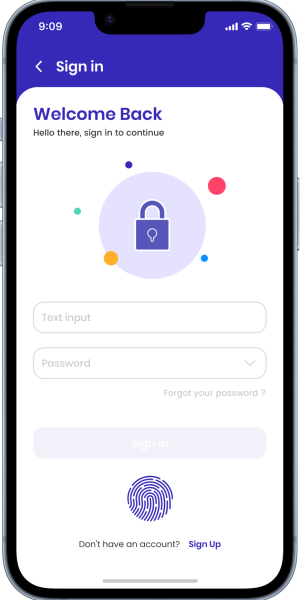

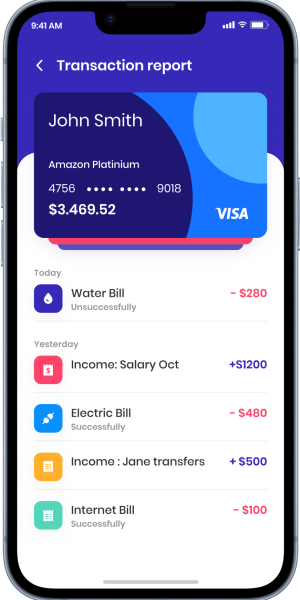

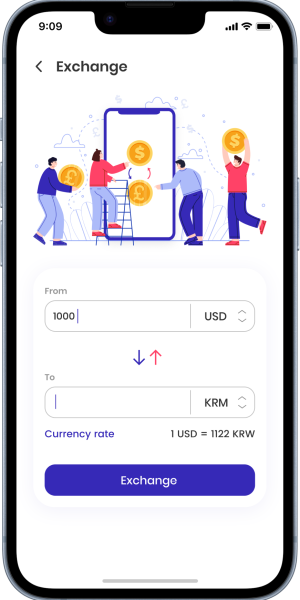

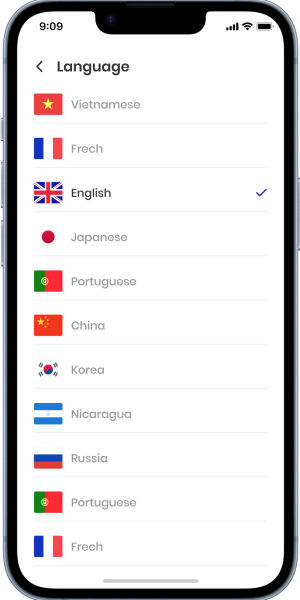

Mobile Designs

Streamlined mobile design for accounting management software: intuitive dashboards, real-time expense tracking, simplified invoicing, secure data handling, and seamless navigation to manage finances efficiently anytime, anywhere.

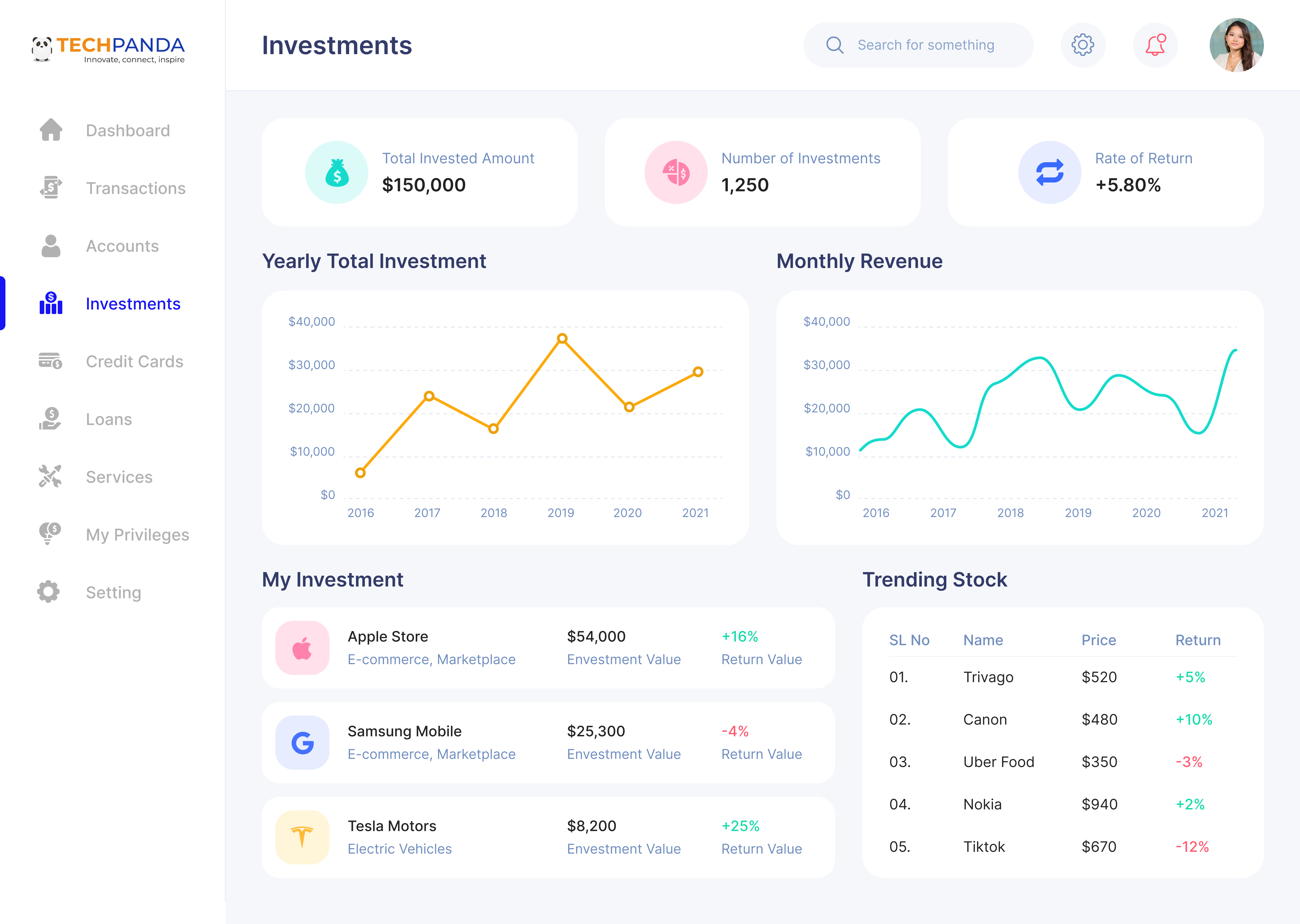

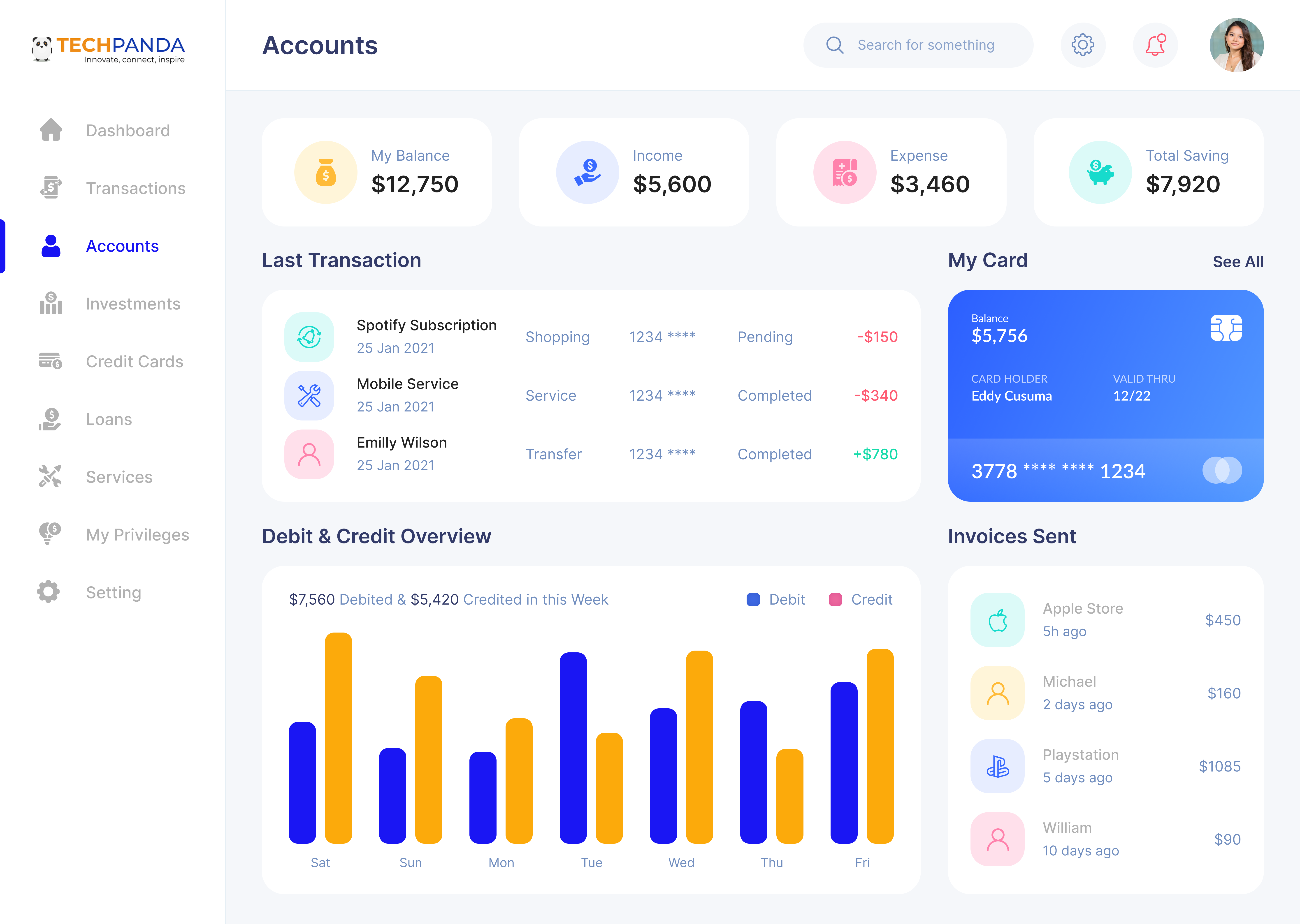

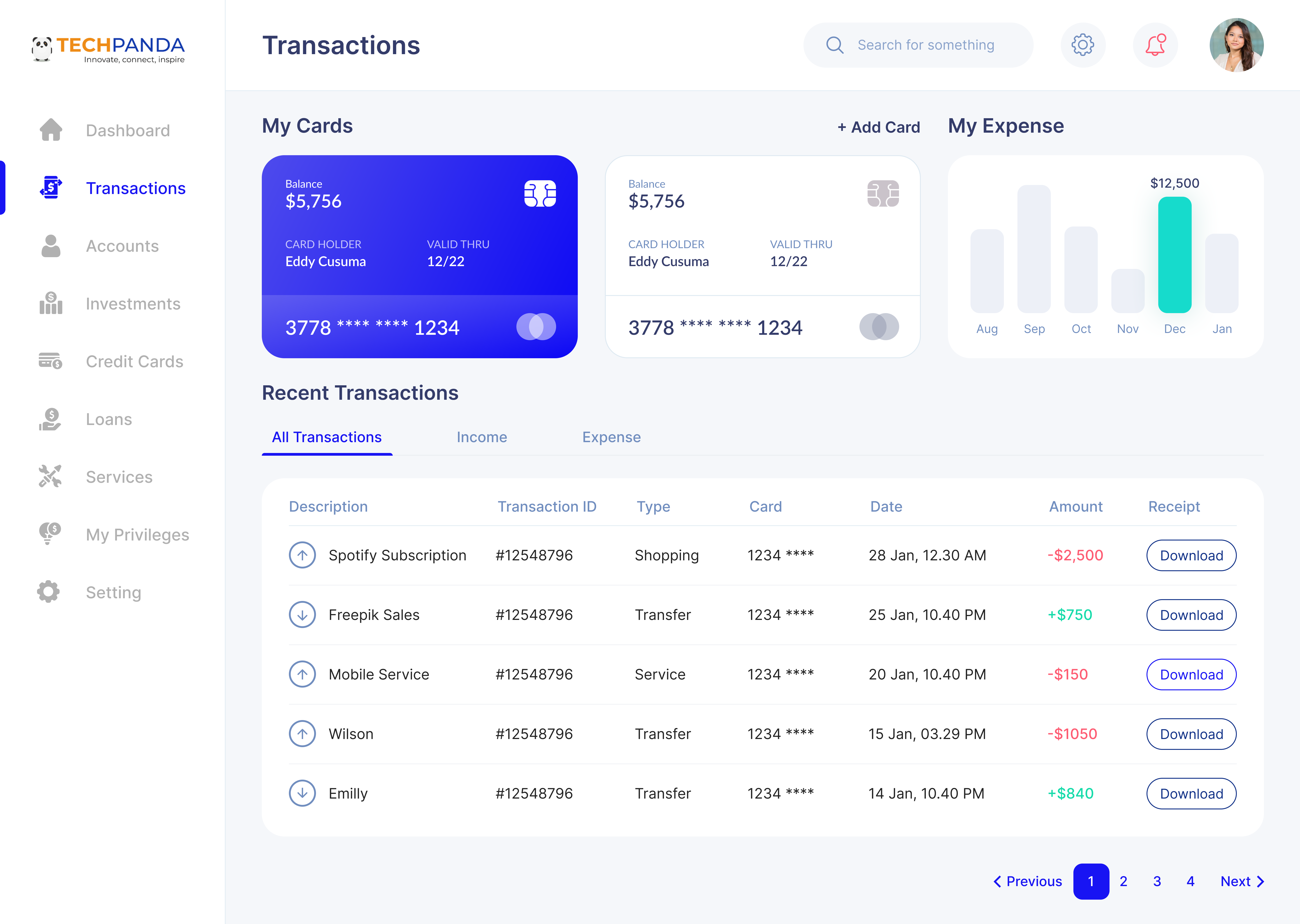

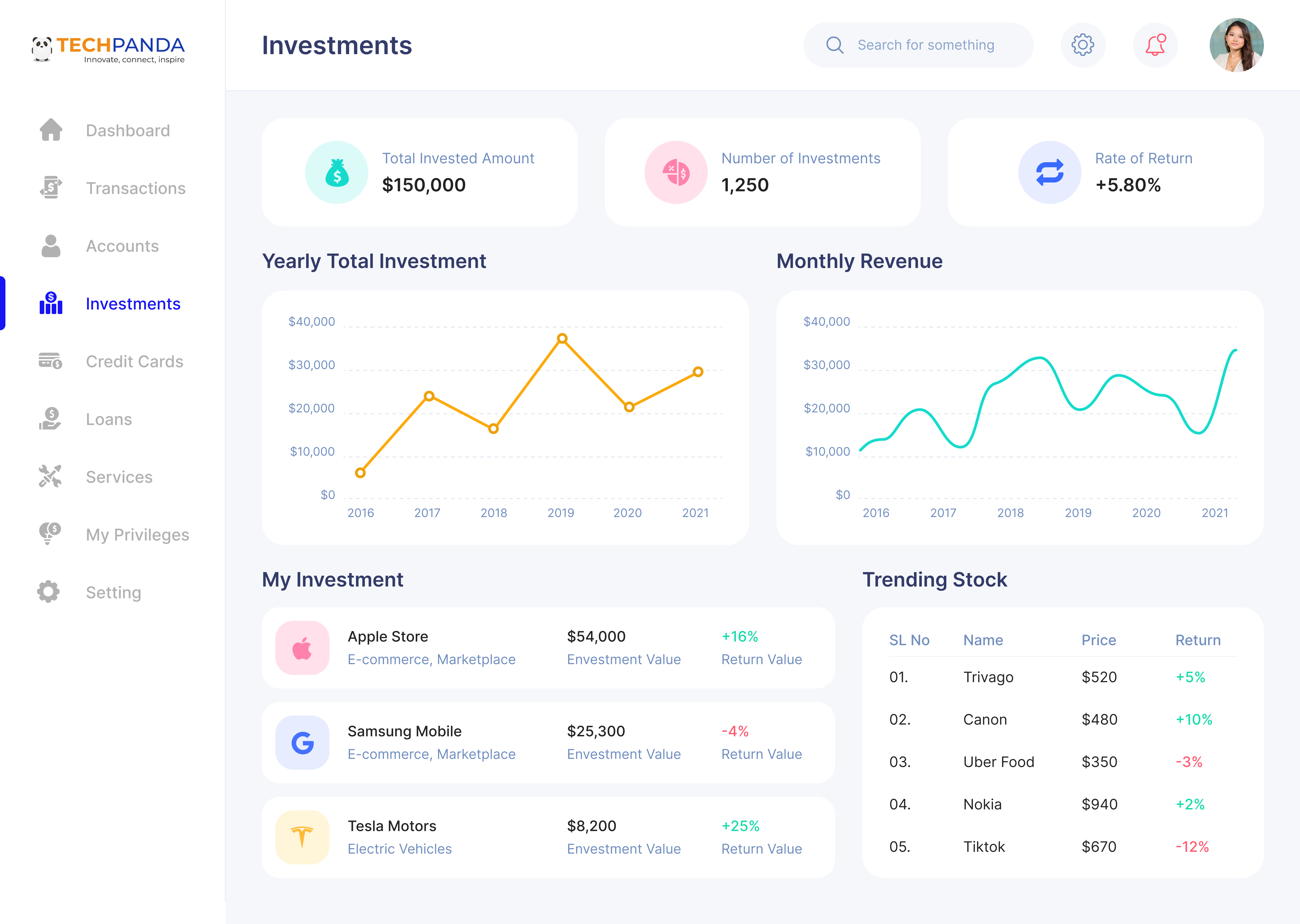

Web Design

To offer companies an easy-to-use, easily integrated platform for tracking spending, creating invoices, maintaining compliance, and managing financial records. Businesses of all sizes may make well-informed decisions and manage their finances more effectively thanks to the software's ability to simplify accounting procedures, improve accuracy, and provide current data.

Our Features

User Management

Admins can create, manage, and deactivate user accounts, assign roles, and set permissions to control access levels and ensure security.

Transaction Tracking

Admins can monitor all financial transactions, categorize them, and ensure accurate recording of revenue and expenses for seamless financial reporting.

Reports and Analytics

Admins can generate detailed financial reports, analyze trends, and visualize data to support strategic decision-making and meet compliance requirements.

Invoice and Payment Management

Admins can create, send, and track invoices, manage payment reminders, and reconcile incoming payments to maintain accurate financial records.

Budgeting and Forecasting

Admins can set budgets, monitor actual versus projected expenses, and forecast future financial trends to help with planning and resource allocation.

Tax Management

Admins can manage tax settings, calculate taxes automatically, and generate tax reports, ensuring compliance with local tax laws and accurate filings.

Tax Calculation

Automatically calculate taxes based on current rates and keep track of taxable income to simplify tax filing at year-end.

Invoice Creation & Management

Generate professional invoices, send them directly to clients, and track payment statuses to ensure timely payments.

Bank Integration

Sync with bank accounts and credit cards to import transactions, ensuring accurate financial data and easy reconciliation.

Expense Tracking

Automatically track and categorize expenses, providing insights into spending patterns and helping users manage their budget effectively.

Financial Reports

Generate detailed reports like profit and loss statements, balance sheets, and cash flow statements to monitor financial health.

Multi-Currency Support

Support for managing transactions in different currencies, ideal for international customers or businesses with global operations.

Project Outcomes: Evaluating the Impact

The outcome of the Accounting Management Software project is a comprehensive, efficient, and secure platform that automates financial processes for businesses. It enables real-time tracking of expenses, revenues, and financial reports, streamlining budgeting, invoicing, and tax compliance. The software improves accuracy by reducing manual errors and enhances decision-making with advanced analytics and customizable reporting features. With a user-friendly interface and robust security measures, the system simplifies accounting tasks, ensuring better financial oversight and enabling businesses to focus on growth and strategic planning.

Frequently Asked Questions

Accounting software helps businesses manage and automate financial tasks, including invoicing, bookkeeping, payroll, and tax calculations.

Yes, accounting software is ideal for small businesses, providing easy-to-use tools for managing finances and saving time on manual accounting tasks.

Yes, reputable accounting software uses encryption, multi-factor authentication, and secure cloud storage to protect sensitive financial data.

- Idea Generation- Having a unique idea is the soul of any project, so find the apt solution for a problem to offer your target users/customers.

- Planning & Research- Collect all the required specifics, such as competitors, market gaps, target market, etc. and then plan all the details to make it presentable to the users.

- Wireframing & Prototyping- The UI/UX Development experts prepare the user flow of the project i.e. wireframing. Based on wireframes, the advanced version or the high-fidelity prototypes are designed.

- Development- The high-fidelity prototypes becomes the basic structure for developers to follow and code the project to form a structure and add detailing.

- Testing- Perform multiple testing to check the working of the product and code quality.

- Deployment- Launch the final version of the project on the specific platform i.e. Android, iOS or Web.

No, even for people who are not familiar with accounting, the majority of accounting software is made to be easy to use. Nonetheless, a rudimentary understanding of finance is beneficial.